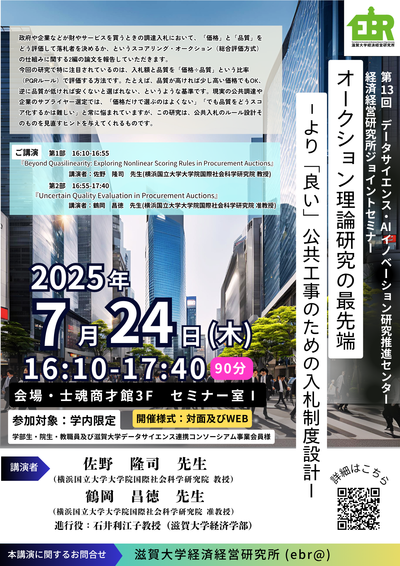

- 日 時:2025年7月24日(木)16:10-17:40

- 講演テーマ:『オークション理論研究の最先端-より「良い」公共工事のための入札制度設計ー』

- 講演者:佐野 隆司 先生(横浜国立大学大学院国際社会科学研究院 教授)

- 講演者:鶴岡 昌徳 先生(横浜国立大学大学院国際社会科学研究院 准教授)

- 会 場:滋賀大学彦根キャンパス 士魂商才館セミナー室Ⅰ

- 開催様式:対面及びZoom開催

- 参加対象:学内(学部生・院生・教職員)及び滋賀大学データサイエンス連携コンソーシアム事業会員様

- 司 会:石井利江子 教授(滋賀大学経済学部)

講演概要

政府や企業などが財やサービスを買うときの調達入札において、「価格」と「品質」をどう評価して落札者を決めるか、というスコアリング・オークション(総合評価方式)の仕組みに関する2編の論文を報告していただきます。

今回の研究で特に注目されているのは、入札額と品質を「価格÷品質」という比率(PQRルール)で評価する方法です。たとえば、品質が高ければ少し高い価格でもOK、逆に品質が低ければ安くないと選ばれない、というような基準です。現実の公共調達や企業のサプライヤー選定では、「価格だけで選ぶのはよくない」「でも品質をどうスコア化するかは難しい」と常に悩まれていますが、この研究は、公共入札のルール設計そのものを見直すヒントを与えてくれるものです。

【第1部】ご講演(16:10-16:55)

表題1:『Beyond Quasilinearity: Exploring Nonlinear Scoring Rules in Procurement Auctions』

講演者:佐野 隆司 先生(横浜国立大学大学院国際社会科学研究院 教授)

【第2部】ご講演(16:55-17:40)

表題2:「Uncertain Quality Evaluation in Procurement Auctions」

講演者:鶴岡 昌徳 先生(横浜国立大学大学院国際社会科学研究院 准教授)

講演報告

本セミナーは対面とZoomを併用する形で行われ、学部生・大学院生・教職員に加え、滋賀大学データサイエンス連携コンソーシアムの会員の皆様にも幅広くご参加いただきました。講演は二部構成で行われました。第1部では佐野教授より "Beyond Quasilinearity: Exploring Nonlinear Scoring Rules in Procurement Auctions" と題する研究成果が紹介されました。本研究は、価格と品質を「価格÷品質」(PQRルール)という比率で評価する総合評価方式の入札を理論的に分析するものです。第一得点方式と第二得点方式の比較を通じて、従来広く研究されてきた準線形スコアリングルールとは異なる均衡行動が導かれることを明らかにし、入札ルールの設計が公共調達における価格と品質の水準に与える影響について新たな知見を提示されました。

続く第2部では鶴岡准教授より「Uncertain Quality Evaluation in Procurement Auctions」と題する研究報告が行われました。ここでは、調達主体による品質評価が不確実性を伴う場合を想定し、入札者がどのような戦略を採用するかを分析されています。第一得点方式では入札者が慎重な行動を取らざるを得ない一方、第二得点方式では真実を反映した入札均衡が成立することが示され、評価精度の向上が期待価格や品質に与える影響についても理論的な考察がなされました。公共調達において避けがたい主観的評価や情報の不完全性を踏まえた分析は、理論的にも実務的にも大きな示唆を与えるものでした。

講演後の質疑応答では、参加者から多数の質問やコメントが寄せられ、公共調達の現場での適用可能性等、活発な議論が展開されました。経済理論の精緻な分析と現実の制度運用との接点に関心が集まり、参加者がそれぞれの専門的視点から意見を交わす有意義な機会となりました。

本セミナーは、オークション理論の最新成果を学ぶとともに、公共工事や調達制度における「より良いルールづくり」について多角的に考える契機となり、盛況のうちに終了いたしました。

(文責:経済学部教授 石井利江子)

--講演の風景--

本ページに関するお問い合わせは

滋賀大学経済経営研究所

TEL : 0749-27-1047 /FAX : 0749-27-1397

E-mail:ebr(at)biwako.shiga-u.ac.jp ★(at)を@に変更して送信してください。